Running a credit check on a tenant can be an important part of the tenant screening process and a good way to help ensure landlords find qualified renters for their rental property. Once a prospective tenant completes a rental application, you’ll need to:

Note: This guide is for informational purposes only. Zillow, Inc. does not make any guarantees about the sufficiency of the information in or linked to from this guide, or that it’s compliant with current, applicable or local laws. Landlord-tenant laws change rapidly and may be regulated at the federal, state and local levels. This resource is not a substitute for the advice or service of an attorney; you should not rely on this resource for any purpose without consulting with a licensed attorney in your jurisdiction.

A rental credit check helps demonstrate a tenant’s history of responsible borrowing, meaning they pay their debts on time (and are more likely to pay their rent on time). It also helps show whether they can afford to live in your rental property.

Before you can run a credit check on rental applicants, each applicant over the age of 18 must submit a completed rental application and give the landlord permission to check their credit. As the landlord, you must follow all Fair Credit Reporting Act guidelines and be able to verify that you’re the actual landlord. Here’s what you’ll need to prepare for the rental credit check:

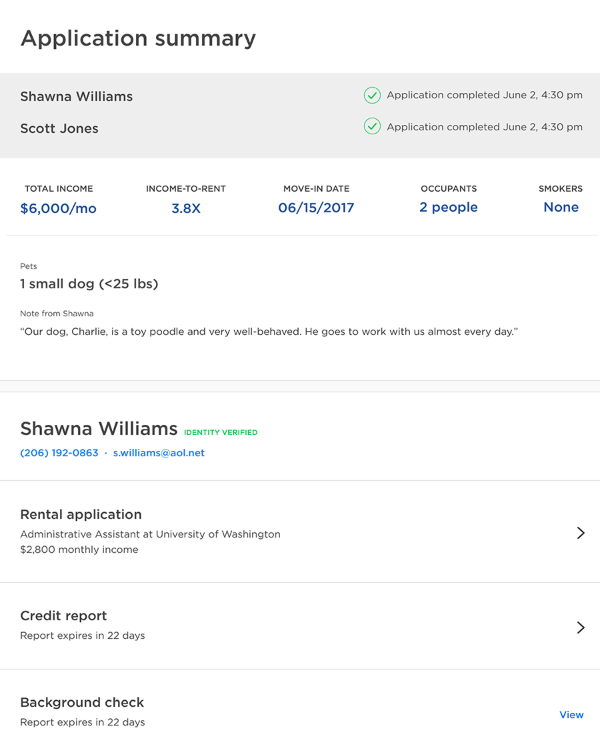

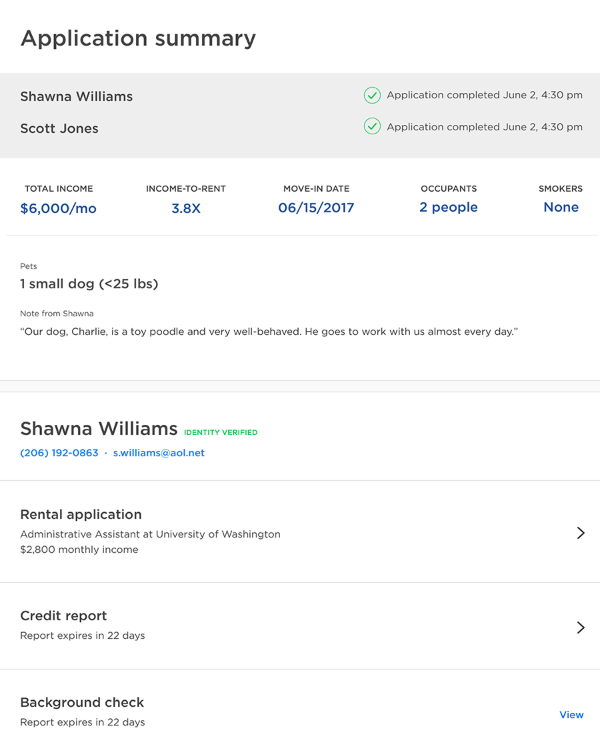

The application will contain the tenant’s:

Because a credit report for renters requires an applicant to provide sensitive personal information, it’s a good idea to use an online service that lets the applicant securely provide all personal information themselves. If you’re using an online service, the service may be able to collect that consent on your behalf. Otherwise, you should work with an attorney to get a consent form for your applicants.

Most companies will require you to submit information confirming that you’re the landlord before you can run a credit check . The information they’ll collect will typically include:

There are several providers that offer self-serve credit report services to landlords, but the most common way is to go through one of the three major credit report bureaus:

Zillow’s application and screening tool includes a tenant’s rental application, a credit report from Experian and a background check from Checkr. You just need to input the tenant’s email address and the service does the rest. Once the tenant has completed their part and the credit check is complete, you’ll receive a notification to view their tenant credit report online.

The three main credit bureaus — Equifax, Experian and TransUnion — will charge a fee, typically around $25 to $75 per applicant, depending on the information requested (such as a criminal background check in addition to the credit report).

Zillow’s application and screening tool provides you with an Experian credit report and Checkr background check at no cost to you. The applicant will pay a $35 fee, and they can use the reports for any Zillow rental application they complete within the next 30 days.

In some states, you can request that prospective tenants pay an application fee to cover the cost of the background and credit checks, or you can absorb the cost yourself. Ultimately, it’s up to you to decide who ends up paying for the rental credit check. Some areas may impose a limit on how much you can charge an applicant, so be sure to comply with state and municipality laws.

If you screen a lot of applicants, subscribing to a credit check service may be more cost-effective for you. You may end up paying less per report.

With most services, it can take 2-10 days to get approval to run a credit check on prospective tenants. After you’re approved, the results of the credit report are typically available within an hour.

Zillow Rental Manager provides screening results without the wait — after the applicant has submitted the application and you’ve verified your identity, the tenant credit report is available within minutes.

It’s often best to run your own landlord credit check, but some prospective tenants who have applied elsewhere may already have a recent copy of their credit report. In most states, a landlord isn’t required to accept a credit report from the tenant — but some states, like Wisconsin, prohibit landlords from charging a tenant credit report fee if the applicant provides their own credit report that’s less than 30 days old. You can still run your own credit report on the prospective tenant, but you’ll have to get their permission and pay any associated fees.

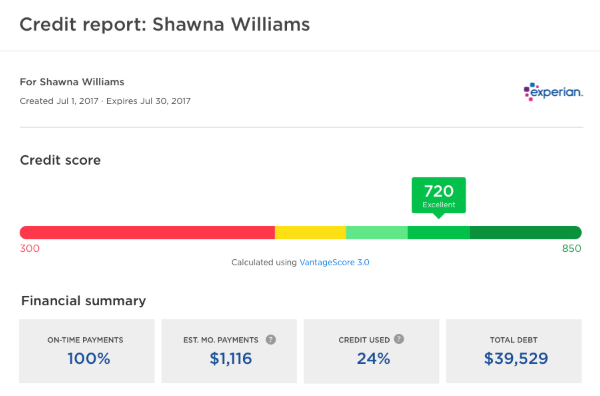

A credit report is a detailed snapshot of a person’s borrowing history that typically includes information from banks and other financial institutions, creditors and public records.

Reports from different bureaus and services look slightly different, but all tenant credit reports should contain:

At the top of the report, you’ll find applicant information like:

This section alerts you to potential fraud — be sure to review and verify any of these discrepancies with the applicant.

You’ll see a summary section that generally includes records of the following:

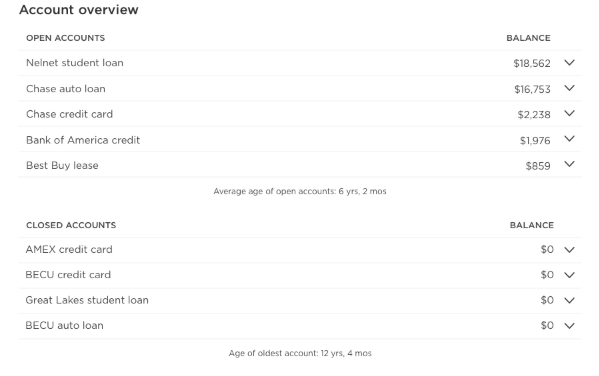

This shows you how consistently the applicant meets their monthly financial obligations. All accounts — both open and closed — will be listed here, along with your prospective tenant’s payment history. You’ll see:

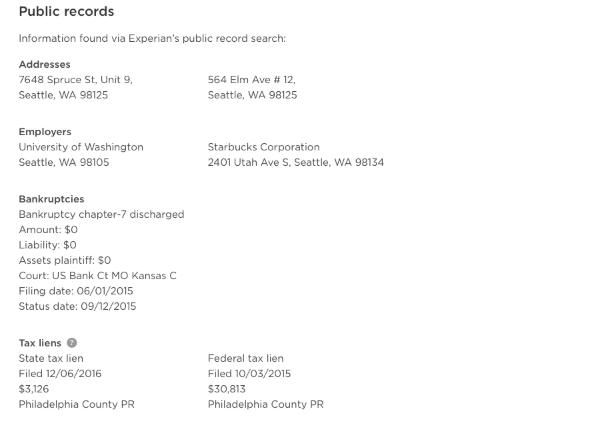

While not included in every credit report, some types of public records could be shown on your applicant’s credit check. If there are liens or other filings, you’ll probably want to ask the applicant for more details. Potential records include:

Some records won’t appear on this report, depending on their recency and level of seriousness.

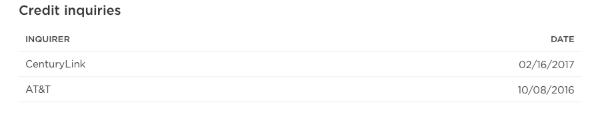

When someone requests a credit check, it will appear on the tenant’s credit report. This section outlines the inquiries and which institution or business performed them. There are two types of credit inquiries:

Hard inquiries: These are performed by a lender or financial institution and will affect the credit score, especially if several inquiries are performed in a short period of time.

Soft inquiries: These occur as part of a background check (or when someone requests a copy of their own credit report) and don’t affect the credit score. A tenant credit check is an example of a soft inquiry.

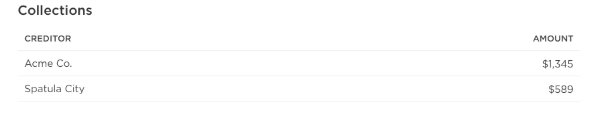

This section of your tenant credit report will show whether any of the applicant’s accounts are in collections. This includes unpaid medical bills, student loans and other types of debt. You’ll have insight into how much has been paid and how much is outstanding.

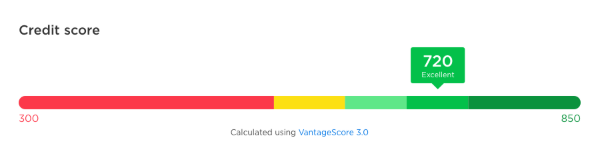

Depending on the service and credit bureau, the tenant’s credit score may vary slightly. Common scores include the FICO® score and the VantageScore. Both models generate scores within a range from 300-850. In general, when reviewing credit scores, you can use the following scale :

As of September 2019, the average FICO score in the U.S. is 703. However, the typical American renter is 33 years old — and average credit scores segmented by age look much different:

Many factors negatively impact a tenant’s credit score . For example, the tenant’s score might be low if:

While the credit score is important, look at it as part of the larger credit story. A great renter might have suffered a setback and have a low credit score, but they could be working to build it back up. And someone with an excellent score may turn out to be a less-than-desirable renter.

If an applicant has an outstanding medical bill or is recovering after a period of unemployment, they might have negative items on their credit report or a lower tenant credit score but may still be a good candidate for your rental property.

If the tenant credit check form comes back with a high score, they are more likely to pay their bills on time and have a favorable income-to-debt ratio. Make sure to run a background check before making your final decision and moving forward with a lease agreement.

There are several reasons why a person may not have a credit history, including:

If the tenant credit check comes up empty, you can use employment verification and criminal background checks to verify the information they provided in their application.

If you run a credit check on a tenant and they have a low score, be sure to carefully review the credit report. There are often mistakes or things the tenant was unaware of, but is willing to fix. Some good renters may have had hard times in the past, but are working to improve their credit.

Before rejecting an applicant:

Renting to someone with poor credit:

Even if the tenant credit check comes up with negative results, you may still decide to rent to that person. If so, you may want to consider asking them to add a cosigner or guarantor to their lease.

One person out of five has an error on their credit report — so it’s a good idea to verify your landlord credit check and make sure your information is accurate. Some ways to do this are:

If any of the information you gather doesn’t match the application, talk to the tenant about the discrepancies. If you decide to reject an applicant, be sure to comply with all applicable fair housing laws .

Once you’ve reviewed the credit and background checks for tenants and decided to accept a prospective renter, these are your next steps:

For more articles, tips and tools for landlords, visit our Rentals Resource Center .